Are Superannuation funds actually Super?

A good plan

In Australia, employers have to pay a "compulsory" 9.5% (on top of wages) into their employees' superannuation account . This would then become the pension fund that the (ex)employees live off till they kick the bucket. Theoretically, it is a perfect plan. You would have money to retire and have a good life. This also come with other benefits such as total permanent disability, life/death and income continuance insurance.Probabilities

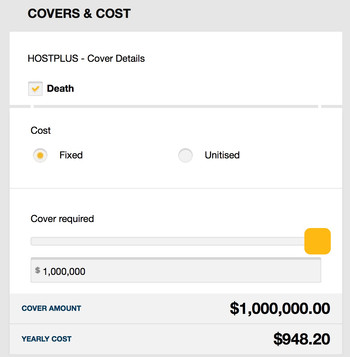

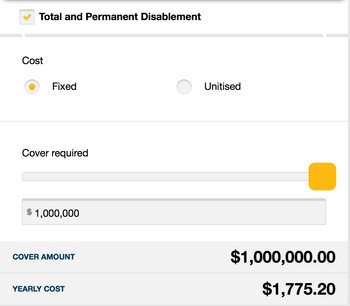

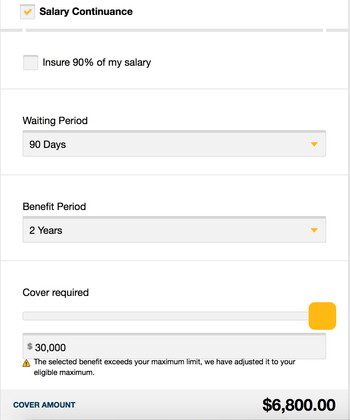

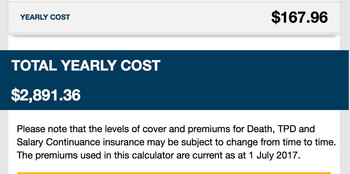

Life covers is a contract where beneficiaries are paid the sum insured upon your death. A funeral cost between $4,000 to $15,000 and if you are a healthy middle aged who exercise, sleep well, eating rib eyes in moderation, ask yourself this, do you need $1,000,000 in life cover? And you are paying $80 per month, which adds up to $960 per year! And most funds often include income protection and TPD as mentioned before, that's an additional ~$1,800 per year.Altogether you would be paying $60,718.56. (years to retirement x premiums per year = 21*$2891.36)

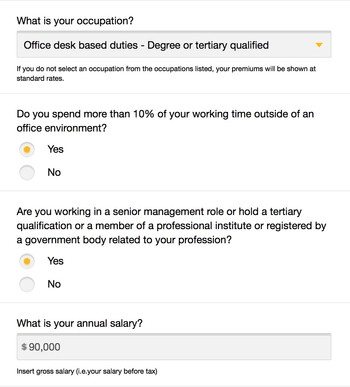

Below I have used the premium and cover calculator from Hostplus Superannuation fund. (assumption is based on a 44-year-old, non-smoker, male working in an office based job)

Ignorance is bliss

That said, there's a reason why superannuation fund management companies are expanding rapidly. Making it a necessity is one factor but also because people don't realise how much they are paying in premiums. In one of the episode by Four Corners, they asked the public about their fund structure and it pains me to say that people aren't bothered. Money paid indirectly to employees through their super account is money nonetheless, and it should be treated the same as wages. You wouldn't let people take from what you have earned, so why would you let insurance premiums and embedded cost in the fund eat away the money you plan on retiring and living the rest of your life on.

*Disclaimer: I am not bashing insurance or superannuation companies. Above is merely my opinion and I have nothing to gain from it.

*Disclaimer: I am not bashing insurance or superannuation companies. Above is merely my opinion and I have nothing to gain from it.

Comments

Post a Comment